We recently launched our new website with the help of Birmingham-based Markstein.

Suzanne Echols oversaw the project and I think they did a fantastic job. The new site features a 1.5 minute video describing the logic behind our unanchored strategy. We worked really hard to distill our investment thesis into this short video and I hope you’ll check it out.

Note the slightly irregular tree rings on the front cover and throughout our website. The tree rings echo our founding logo, an oak tree, back in 2005. We chose the tree as a metaphor for the stability and strength of a well-conceived real estate investment. We believed that if we could put together multiples of those well-conceived CRE deals, we could produce a crop each year for our investors. This most recent quarter’s distributions mark our 71st consecutive quarter of partner distributions. We hope that we’ve provided a steady and predictable investment for our investors and plan on doing that for many years to come.

The past few months of business news have driven me nuts. I keep seeing headlines like:

“Commercial Real Estate Could Crash Soon” – Fox News” or “Commercial Real Estate Prices Could Crash 40% From Their Peak in a Worse Crash Than 2008” -Yahoo Business

Those headlines are as informative as saying, ‘Today it will rain in the United States’.

Which parts of CRE are in trouble? How big of a crash? What’s next?

I’ve spent the past few months speaking with brokers, reading articles and researching quarterly earnings calls gauging what is happening. Before we discuss the specifics within the CRE market, it’s essential to understand the global economic backdrop we find ourselves in. After all, if you don‘t recognize the season, you can’t make a good forecast. Eric Peters, CIO at One River Asset Management, notes that liquidity is drying up. And he places the blame squarely at the feet of our central bankers who have melted financial space and time over the past 10 years using QE and its ilk.

Interest rates are the price of time, so, in a way, last decade’s monetary policy experiment was really a time distortion experiment. Crossing the zero bound in interest rates, like exceeding the speed of light with matter, causes our sense of time to become unfixed. Future values and present values converged and became indistinguishable. Time became irrelevant. Financial valuation, at its core, is about valuing future cash flows. Taking interest rates near or below zero across almost all time horizons completely distorted the idea of time in that cash flow valuation process.

Now that time matters again, we’re starting to realize that a lot of money we thought was on hand is trapped in the future. You hear it all the time from the house you no longer want to sell because the mortgage rate is too low, to the PE deal you’re holding longer than you anticipated. Good or bad, people have all kinds of financial holdings they thought they’d be trading in the present but it’s now too expensive not to hold well into the future. It is creating all kinds of unexpected illiquidity and distortions. It’s not that the capital doesn’t exist. It’s just that it exists in a different time than we thought it did. And inflation is a catalyst that exposes these time distortions.

Eric Peters

To state Mr. Peters’s position in a different way, if you bought a freestanding Starbuck’s for a 3.75% cap rate in 2021, you won’t be seeing your capital for a very long time. Especially given that the prime rate is now 8.25%. You’ve locked that money up until either Starbuck’s rent increases sufficiently or rates come back down again. With that ‘economic original sin’ as the macro backdrop, let’s dive into CRE and see where problems exist and what might happen over the next 12-24 months.

CRE MARKET OVERALL

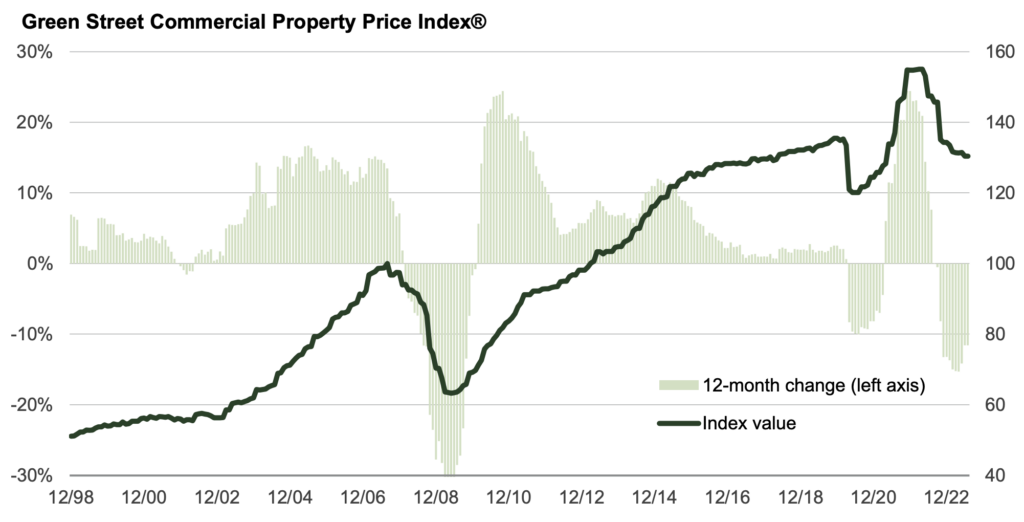

CRE values are down 16% since March of ’22.

OFFICE

It’s bad and getting worse.

- 30% of LA’s office buildings are empty.

- San Francisco is 20% vacant

- Austin 22.2% (with another 6.22MM SF under construction)

- Houston 23.4%

- Dallas 17.2%

Offices have lost 31% of their value since the Fed started raising rates. When you see generic headlines about commercial real estate crashing, this is what they’re talking about. To appreciate how difficult of a position these landlords are in, we need to look a little deeper into the business model of owning and leasing office buildings.

Office buildings can be cash incinerators. They require much more capital to operate than similarly sized retail or industrial properties. When an office vacancy is leased to a new tenant, the Landlord typically spends $30-45 per square foot to build out the space to the new tenant’s liking. That can represent 2 to 3 years’ worth of rent before the LL makes a dime.

Couple that with the trends of working from home, co-working, smaller footprints, an eventual recession and you have a big mess. Landlords have no incentive to add a dime to their worsening situation, and many will send their lenders envelopes that jingle.

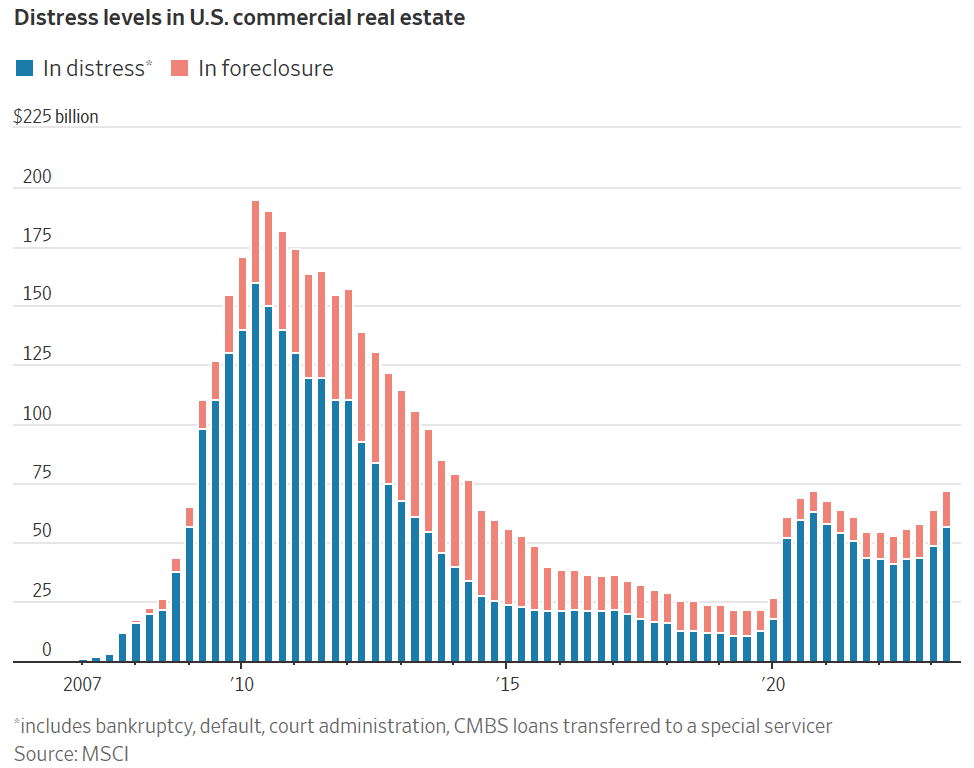

The office sector represents appx $730 billion of the total $4.4 Trillion in outstanding CRE debt. Approximately $116.8 billion in office debt matures in 2023. That’s a big deal but it’s not 2008 again.

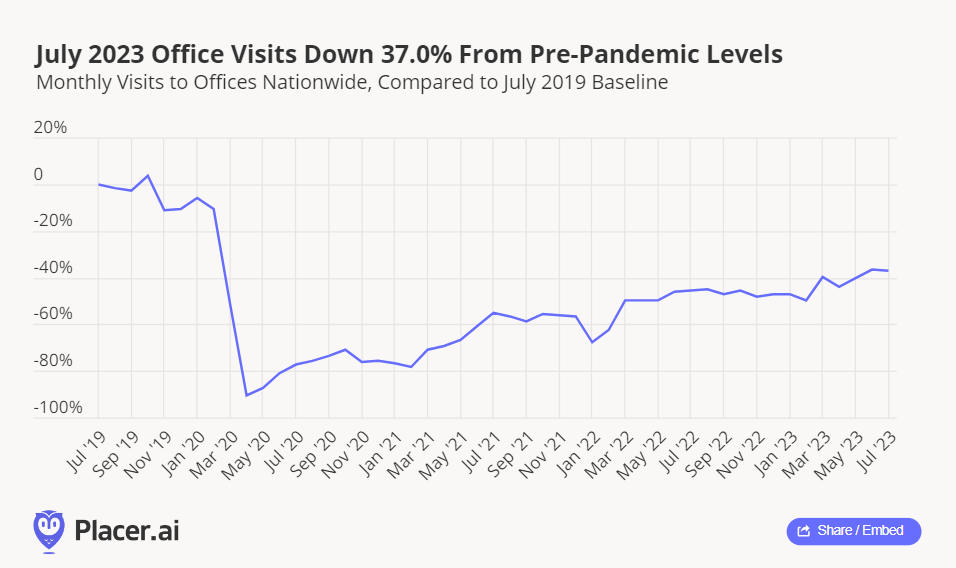

So when, if ever, do workers fully return to the office? I think we’ll see a 20% slice of employees who will never return. Certain jobs can be performed from home with no drop-off in productivity or quality.

The remaining holdouts will likely return once the employment rate grows during a recession.

On the bright side, Office visits do continue to climb month over month as you can see from the chart to below:

MULTIFAMILY

I tell my Multifamily friends that they are the smartest practitioners in the CRE world. Apartment owners have killed it over the past 7-10 yrs. Demographics and a general lack of housing in the US have been a fantastic tailwind for them and this continues.

Broadly speaking, cap rates have increased (lowering pricing) by 100+ BPS. Rent rolls are still strong, but weakness is starting to show up.

The big threat to multifamily development is coming from a lack of lending. Speaking with a local buyer of apartments across the country, he has seen a 90% reduction in the number of lenders willing to offer a term sheet for a development loan.

On the acquisition side, volume is way down. For the few deals that are clearing, we’re seeing low 5 caps against a 5.75-6.50% loan. This equates to a negative spread of 75-150 basis points. And the hope is that rental rates will shrink that gap.

However, property expenses are increasing. The two main areas are insurance and property taxes. Insurance has increased by 50-100% over the past couple of years. In Florida, rates have jumped from an average of $800 per unit to $3,000-$4,000. And tax assessors across the country have been very aggressive in their reappraisals.

All in all, Multifamily is still in favor of institutions but buying has slowed down.

INDUSTRIAL

Warehouses in the US have lost only 8% in value from peak.

Reshoring, friend-shoring, and redundancy in the supply chain have been structural changes driving values and demand in the Industrial market.

Here in the Southeast, rent rolls are holding up well. However, lending for new development, like multifamily, has almost stopped. Two years ago, a developer might have received eight term sheets from lenders and today, they might get one.

Industrial is still strong and institutions are still carefully buying the product.

RETAIL

For the past decade, retail has been a bad word within the greater investment community. The fear of Amazon decimating brick-and-mortar retail has more than kept developers in check. Today there’s not enough retail space to meet demand. At SW our retail portfolio is as full as it’s ever been.

Publicly traded REITS are crowing about their current pricing power. Brixmor set an all-time high new lease rate during the previous quarter. At SW we have a policy to achieve at least 4% annual increases for any new lease in Florida- due to the favorable market dynamics.

Despite the fantastic operating backdrop, lending has slowed for retail and Sellers still haven’t adjusted to the new cost of financing. This has made for a tough buying environment. And that’s what we’ve been fighting for the last 9-12 months. The past 2-3 weeks of rising rates has now made it even more difficult.

SUMMARY

In conclusion, tenant demand is still good to great for everything except for Office. But interest rates continue to climb reducing property values for all asset classes. Distress levels for CRE loans are slightly elevated and should start to climb higher, but as of yet are nowhere near the peak of the GFC.

My advice for CRE investors would be to avoid office for now, and try to find sellers of multi, industrial or retail who are being forced to sell. Otherwise, sit on your hands until sellers’ prices have adjusted to the new higher rates or something breaks in the

economy and rates start to turn back downwards.

In the meantime, if we can help you with any of your real estate needs please reach out and we’d love to assist you.

Download PDF version