For me, one of the great challenges in life is to better understand how our economy works. It’s like a weather system, with billions of inputs creating various outcomes. While we can’t know with certainty what will happen next year, we can spot patterns that in the past have created certain outcomes. We can assign probabilities to those outcomes and hopefully plan accordingly.

What follows stems from my quest to better understand the biggest economic question of 2021—inflation. Most people reading this letter have never experienced a serious bout of inflation.

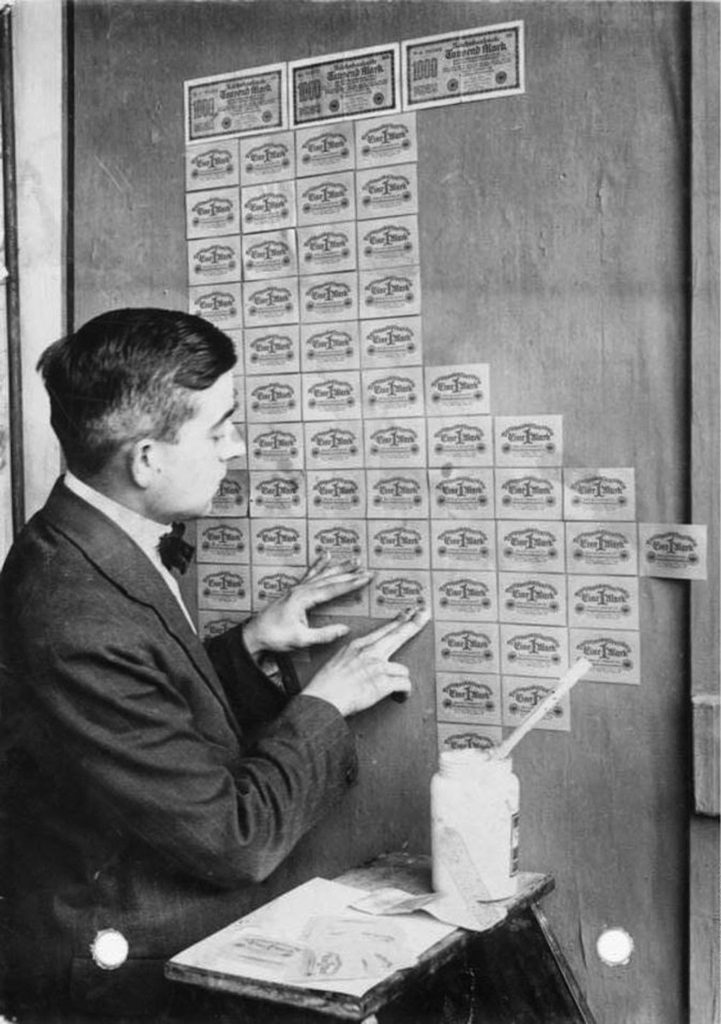

The story that follows is about a massive inflation that occurred 100 years ago. If you’re in a hurry, consider printing this out for later, when you have time, a good drink and a comfortable chair. I promise it will be eye opening.

BACKGROUND

On June 28, 1919—five years to the day after Archduke Ferdinand was assassinated by a Serbian Nationalist–the Treaty of Versailles was signed, ending World War I. Article 231, the “war guilt” clause forced Germany to accept responsibility for causing the war. The resulting reparations included forced reduction of the armed forces, grounding of their air force, loss of large swaths of farmland and the equivalent of 132 billion gold marks due to the victors.

Under these choking penalties, the working-class in Germany began to revolt against the government. Kaiser Wilhelm II could see the writing on the wall, abdicated his throne and fled to the Netherlands.

Frederich Ebert, the leader of the Socialist Democratic Party, assumed power and formed the Council of the Peoples Deputies. The new Free Socialist Republic of Germany began installing new reforms such as

national health insurance, welfare reform and granting more power to labor unions.

Once the full government was formed, its first task would be to determine how to begin repaying its debts with less resources. Throughout history, governments who’ve endured a financial shock, whether it be war or plague, have had three choices:

- Tax the population

- Reduce government spending

- Inflate the currency by printing more units

To no one’s surprise, Germany chose the 3rd option. In fact, 6 years earlier as war began, Germany abandoned the gold standard. In hindsight, this was the first seed sown for the hyper-inflation that would follow in 1923.

The period of 1920-21 was actually a boom time for Germany. As they continued to print more dollars (cough) marks, Germans enjoyed a growing economy. If u could time travel back to that era, you’d see low unemployment in the urban areas, bustling cities with new factories and warehouses as far as the eye could see.

Those boomtimes stood in the starkest of contrast to the final days of the Reichsmark, where the entire circulating supply of marks couldn’t buy one American newspaper.

THE BOOK

Now that we’ve established the timeline for the story, I’ve excerpted portions from DyingofMoney. This out-of-print book seems to be at the very top of the list for economists who study that period in history. As I started reading it a few months ago, I became unnerved by how similar things sounded in German society compared to the United States today.

Let me be clear, I do not believe the US Dollar will suffer a complete debasement like the German Reichsmark. After all, we’re the global hegemon with the world’s reserve currency. Germany was much smaller. However, recent Federal Reserve actions have at least put that option on the table. In fact, we now have 40% more dollars in the money supply than just 12 months ago and 322% more dollars than in 2000! Therefore, it is prudent to understand that period in history so we can start looking for patterns.

What was it like to be alive in Germany in the early 20’s? As it turns out, a lot like the United States in 2021. See how many parallels you find with our current society and economy (with my running commentary in italics):

EXCERPTS FROM DYING OF MONEY BY JENS O. PARSSON

“Germany’s money supply doubled again during this period of stable prices (from late 1919 to 1921). It was this time, when Germany was sublimely unconscious of the fiscal monsters in its closet, which was undoubtedly the turning of the tide toward the inflationary smash. The catastrophe of 1923 was begotten not in 1923 or at any time after the inflation began to mount, but in the relatively good times of 1920 and 1921.

The life of the inflation in its ripening stage was a paradox which had its own unmistakable characteristics. One was the great wealth, at least of those favored by the boom.

Side by side with the wealth were the pockets of poverty. Greater numbers of people remained on the outside of the easy money, looking in but not able to enter. The crime rate soared. Although unemployment became virtually nonexistent and many of the workers were able to keep up with the inflation through their unions, their bargaining, and their cost-of-living escalator clauses, other workers fell behind the rising cost of living into real poverty. Salaried and white-collar workers lost ground in the same way. Even while total production rose, each individual’s own efforts faltered and showed a measurable decline, and the quality of production deteriorated.

When our Fed increases dollars in circulation, they utilize the banks to make more loans.And those that are closer to the printing presses of the banks receive those new dollars. CRE investors have certainly benefited handsomely from 2008 to present. But those who can’t borrow money are left further behind.

Accounts of the time tell of a progressive demoralization which crept over the common people, compounded of their weariness with the breakneck pace, to no visible purpose, and their fears from watching their own precarious positions slip while others grew so conspicuously rich. Feelings of disunity and dissent were epidemic among the Germans. Regional separatism was so strong that it came close to breaking up Germany into fragments.

America is more divided today than any other time since I’ve been alive. And I believe one of the root causes is the growing wealth disparity.

The cities, particularly in the eyes of the austere country folk, had an aimless and wanton youth and a cabaret life of an unprecedented splendor, dissolution, and unreality.

When money was so easy to come by, one took less care to obtain real value for it, and frugality came to seem inconsequential.

Speculation alone, while adding nothing to Germany’s wealth, became one of its largest activities. The fever to join in turning a quick mark infected nearly all classes, and the effort expended in simply buying and selling the paper titles to wealth was enormous. Everyone from the elevator operator up was playing the market. The volumes of turnover in securities on the Berlin Börse became so high that the financial industry could not keep up with the paperwork, even with greatly swollen staffs of back-office employees, and the Börse was obliged to close several days a week to work off the backlog.

Robinhood, Gamestop and Dogecoin anyone?

The boom suspended the normal processes of natural selection by which the nonessential and ineffective otherwise would have been culled out. Practically all of this vanished after the inflation blew itself out.

How many zombie companies in the US have been propped up by low interest rates and government transfer payments?

Once begun, the inflation required ever more inflationary expansion just to support the old debts. Germany had to run faster and faster to stay ahead of the engulfing wave, until it simply could not run any faster. Stopping the inflation would have killed the boom, and that seemed excessively unpleasant. In this respect, peacetime inflation was far more insidious than wartime inflation, which produced only war goods to be expended and no boom for the people to become addicted to.

In the best democratic tradition, the government was hopelessly responsive to its sources of support. A government so plainly a weather vane to the prevailing winds was ill suited to override the shortsighted self-interest of its power groups and deal sternly with hard realities.

Politicians never change.

The largest gainer by far, because it was the largest debtor, was the Reich government. The inflation relieved it of its entire crushing debt which represented the cost of the war, reconstruction, reparations, and its deficit-financed boom. Others who were debtors emerged like the government with large winnings. Until the last moment of the inflation borrowers continued to make huge profits simply by borrowing money and buying assets, because lenders never stopped underestimating the inflation. The good fortune of the debtors demonstrated the prudence of following the government’s lead: one must beware of being a creditor whenever the government was a huge debtor.

Here are my takeaways:

- Inflation begins long before you can measure it.

- Politicians and Central Bankers are incentivized to keep borrowing & printing more units until they are forced to stop by an external force- especially in a democracy.

- The longer inflation runs, the bigger the collapse.

- If you’re in an inflationary environment, buy scarce assets like real estate and Bitcoin using debt. Debt gives the borrower the use of today’s stronger dollars while paying back in tomorrows debased dollars.

- Just because German society in the 20’s sounds like America in 20’s doesn’t mean we’ll have the same outcome. Inflation is more than just printing a bunch of dollars. Otherwise, Quantitative Easing 1 & 2 would have produced major inflation, but that didn’t happen. See the following headline from 2011: “Investors Starting to Believe that Inflation Threat is Real”

- No matter what you do, be aware that the Fed is using a massive dollar copying machine on our currency. As they increase the denominator of dollars, we all have to fight harder to just stay in place.

At Shannon Waltchack, we consider ourselves optimistic realists. We believe in taking an unflinching look at current conditions and try our best to peer into the future so we can be the best real estate investors possible.

America is more divided today than any other time since I’ve been alive. And I believe one of the root causes is the growing wealth disparity.